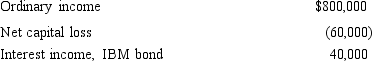

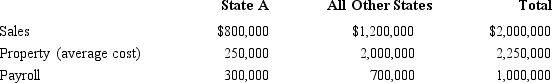

You are completing the State A income tax return for Quaint Company, LLC. Quaint operates in various states, showing the following results.

In A, all interest is treated as business income. A uses a salesonly apportionment factor. Compute Quaint's A

In A, all interest is treated as business income. A uses a salesonly apportionment factor. Compute Quaint's A

taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: State Q has adopted sales-factor-only apportionment for

Q116: Under common terminology, a unitary group files

Q120: In the apportionment formula, most states assign

Q120: Allocation is a method under which a

Q122: Flip Corporation operates in two states, as

Q122: If a gift card is unused after

Q124: Provide the required information for Orange Corporation,

Q126: Kim Corporation, a calendar year taxpayer, has

Q131: A state sales/use tax is designed to

Q160: An ad valorem property tax is based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents