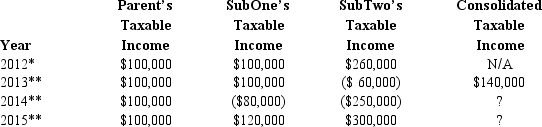

Parent Corporation, SubOne, and SubTwo have filed consolidated returns since 2013. All of the entities were incorporated in 2012. None of the group members incurred any capital gain or loss transactions during 2012-2015, nor did they make any charitable contributions. Taxable income computations for the members are listed below.

* Separate return year.

* Separate return year.

** Consolidated return year.

a. How much of the 2014 loss is apportioned to SubOne and SubTwo? How is this loss treated in generating a refund of prior tax payments?

b. Why would Parent consider electing to forgo the carryback of the 2014 consolidated NOL?

c. In this light, analyze the election to consolidate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: The U.S. states apply different rules in

Q122: Where are the controlling Federal income tax

Q132: For each of the indicated tax years,

Q133: The consolidated income tax return rules apply

Q133: Outline the major advantages and disadvantages of

Q134: List some of the nontax reasons that

Q139: The group of Parent Corporation, SubOne, and

Q139: Consider AB, a brother-sister group of U.S.

Q144: Gold and Bronze elect to form a

Q145: A Federal consolidated group reports a net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents