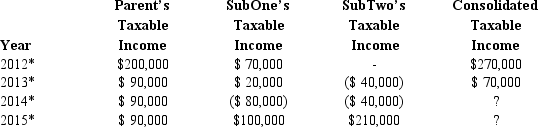

The group of Parent Corporation, SubOne, and SubTwo has filed a consolidated return since 2013. The first two entities were incorporated in 2012, and SubTwo came into existence in 2013 through an asset spin-off from Parent. Taxable income computations for the members are shown below. None of the group members incurred any capital gain or loss transactions during 2012-2015, nor did they make any charitable contributions.

Describe the treatment of the group's 2014 consolidated NOL. Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: Match each of the following terms with

Q119: The U.S. states apply different rules in

Q122: Where are the controlling Federal income tax

Q133: Outline the major advantages and disadvantages of

Q136: Parent Corporation, SubOne, and SubTwo have filed

Q139: Consider AB, a brother-sister group of U.S.

Q142: Gold, Silver, and Tin are the affiliates

Q144: Gold and Bronze elect to form a

Q145: A Federal consolidated group reports a net

Q153: Members of the ABCD Federal consolidated group

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents