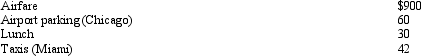

Alfredo, a self-employed patent attorney, flew from his home in Chicago to Miami, had lunch alone at the airport, conducted business in the afternoon, and returned to Chicago in the evening.His expenses were as follows:

What is Alfredo's deductible expense for the trip?

What is Alfredo's deductible expense for the trip?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: Once set for a year, when might

Q113: How are combined business/pleasure trips treated for

Q118: Logan, Caden, and Olivia are three unrelated

Q134: Concerning the deduction for moving expenses, what

Q135: Rod uses his automobile for both business

Q136: For the current year, Horton was employed

Q137: Marcie moved from Oregon to West Virginia

Q138: Samuel, age 53, has a traditional deductible

Q139: Cathy takes five key clients to a

Q144: In terms of IRS attitude, what do

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents