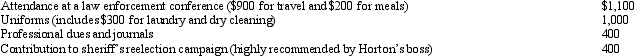

For the current year, Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: For the current football season, Tern Corporation

Q131: Match the statements that relate to each

Q132: In the current year, Bo accepted employment

Q133: Brian makes gifts as follows:

Q134: Concerning the deduction for moving expenses, what

Q135: Rod uses his automobile for both business

Q137: Marcie moved from Oregon to West Virginia

Q138: Samuel, age 53, has a traditional deductible

Q139: Cathy takes five key clients to a

Q140: Alfredo, a self-employed patent attorney, flew from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents