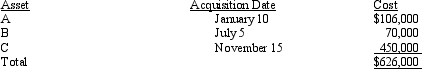

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Jim acquires a new seven-year class asset

Q96: Polly purchased a new hotel on July

Q97: Rustin bought used 7-year class property on

Q98: On July 10, 2012, Ariff places in

Q99: On January 15, 2012, Vern purchased the

Q101: Joe purchased a new five-year class asset

Q101: Discuss the reason for the inclusion amount

Q102: In 2012, Marci is considering starting a

Q103: On August 20, 2011, May signed a

Q104: Norm purchases a new sports utility vehicle

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents