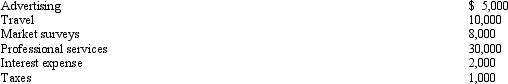

In 2012, Marci is considering starting a new business. Marci had the following costs associated with this venture:

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Correct Answer:

Verified

Q97: Rustin bought used 7-year class property on

Q98: On July 10, 2012, Ariff places in

Q99: On January 15, 2012, Vern purchased the

Q100: Audra acquires the following new five-year class

Q101: Joe purchased a new five-year class asset

Q101: Discuss the reason for the inclusion amount

Q102: Discuss the difference between the half-year convention

Q103: On August 20, 2011, May signed a

Q104: Norm purchases a new sports utility vehicle

Q106: On June 1, 2012, Gabriella purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents