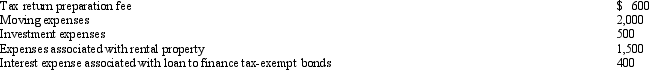

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Q82: Because Scott is three months delinquent on

Q84: For an activity classified as a hobby,

Q93: Nikeya sells land (adjusted basis of $120,000)

Q94: Which of the following is not a

Q98: On January 2, 2012, Fran acquires a

Q100: Priscella pursued a hobby of making bedspreads

Q100: Robin and Jeff own an unincorporated hardware

Q102: Taylor, a cash basis architect, rents the

Q102: During the year, Jim rented his vacation

Q104: The stock of Eagle, Inc.is owned as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents