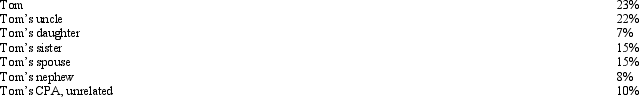

The stock of Eagle, Inc.is owned as follows:

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Cory incurred and paid the following expenses:

Q100: Robin and Jeff own an unincorporated hardware

Q100: Priscella pursued a hobby of making bedspreads

Q102: During the year, Jim rented his vacation

Q102: Taylor, a cash basis architect, rents the

Q105: Sandra owns an insurance agency.The following selected

Q106: Mattie and Elmer are separated and are

Q107: In order to protect against rent increases

Q108: Marvin spends the following amounts on a

Q109: Albie operates an illegal drug-running business and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents