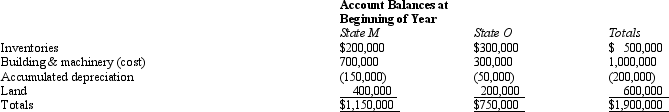

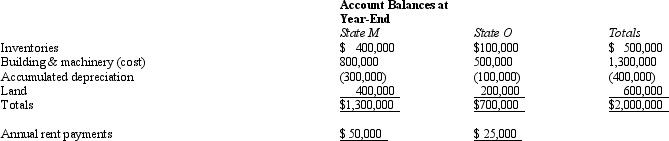

Bert Corporation, a calendar-year taxpayer, owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

Bert's M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Correct Answer:

Verified

Q65: Britta Corporation's entire operations are located in

Q67: Judy, a regional sales manager, has her

Q68: Cruz Corporation owns manufacturing facilities in States

Q69: Given the following transactions for the year,

Q75: Net Corporation's sales office and manufacturing plant

Q76: General Corporation is taxable in a number

Q77: Valdez Corporation, a calendar-year taxpayer, owns property

Q82: In the broadest application of the unitary

Q83: A taxpayer wishing to reduce the negative

Q87: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents