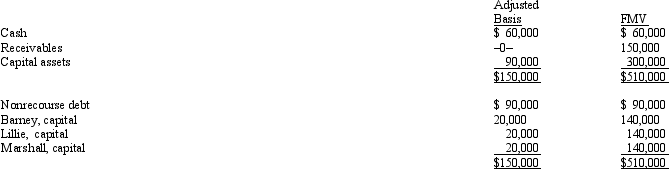

The BLM LLC's balance sheet on August 31 of the current year is as follows.  The nonrecourse debt is shared equally among the LLC members.On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt.Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt.How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members.On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt.Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt.How much capital gain and/or ordinary income will Lillie recognize on the sale?

A) $100,000 capital gain; $50,000 ordinary income.

B) $120,000 capital gain; $0 ordinary income.

C) $150,000 capital gain; $0 ordinary income.

D) $70,000 capital gain; $50,000 ordinary income.

E) None of the above.

Correct Answer:

Verified

Q132: Nicholas is a 25% owner in the

Q133: During the current year, MAC Partnership reported

Q134: Which of the following statements correctly reflects

Q135: Which of the following statements is true

Q136: Match each of the following statements with

Q138: Landon received $50,000 cash and a capital

Q139: Match each of the following statements with

Q140: In a proportionate liquidating distribution, Scott receives

Q141: Harry and Sally are considering forming a

Q142: Karli owns a 25% capital and profits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents