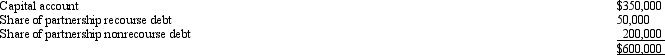

The MOP Partnership is involved in leasing heavy equipment under long-term leases of five years or more.Patricia has an adjusted basis for her partnership interest on January 1 of the current year of $600,000, consisting of the following:

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is a material participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss?

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is a material participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Cassandra is a 10% limited partner in

Q142: Karli owns a 25% capital and profits

Q145: Hannah sells her 25% interest in the

Q146: In a proportionate liquidating distribution in which

Q148: In a proportionate liquidating distribution in which

Q149: The MOG Partnership reports ordinary income of

Q150: Melissa is a partner in a continuing

Q151: Josh has a 25% capital and profits

Q170: Jeordie and Kendis created the JK Partnership

Q204: Sharon and Sue are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents