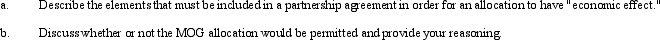

The MOG Partnership reports ordinary income of $60,000, long-term capital gain of $12,000, and tax-exempt income of $12,000.The partnership agreement provides that Molly will receive all long-term capital gains and George will receive all tax-exempt interest income.Their allocation of ordinary income will be reduced accordingly, and Olivia will be allocated a proportionately greater share of ordinary income.(In other words, each partner will receive allocations totaling 1/3 of the total $84,000 of partnership income.) This allocation was agreed upon because Molly and George are in a high marginal tax bracket and Olivia is in a low marginal tax bracket.

Correct Answer:

Verified

Q145: Hannah sells her 25% interest in the

Q146: In a proportionate liquidating distribution in which

Q147: The MOP Partnership is involved in leasing

Q148: In a proportionate liquidating distribution in which

Q150: Melissa is a partner in a continuing

Q151: Josh has a 25% capital and profits

Q154: Allison and Taylor form a partnership by

Q167: In the current year, Derek formed an

Q170: Jeordie and Kendis created the JK Partnership

Q204: Sharon and Sue are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents