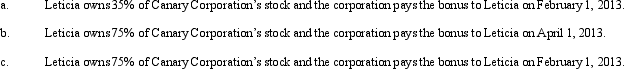

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: Schedule M-1 of Form 1120 is used

Q94: Nancy is a 40% shareholder and president

Q95: On December 28, 2012, the board of

Q96: Ostrich, a C corporation, has a net

Q100: Compare the basic tax and nontax factors

Q102: Compare the taxation of C corporations with

Q103: Mallard Corporation, a C corporation that is

Q104: Jessica, a cash basis individual, is a

Q121: Adrian is the president and sole shareholder

Q124: What is the purpose of Schedule M-3?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents