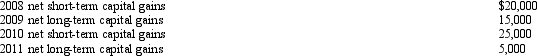

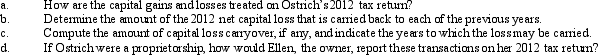

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Correct Answer:

Verified

Q69: Schedule M-1 of Form 1120 is used

Q91: Warbler Corporation, an accrual method regular corporation,

Q92: During the current year, Coyote Corporation (a

Q93: Heron Corporation, a calendar year, accrual basis

Q94: Nancy is a 40% shareholder and president

Q95: On December 28, 2012, the board of

Q99: Canary Corporation, an accrual method C corporation,

Q100: Compare the basic tax and nontax factors

Q121: Adrian is the president and sole shareholder

Q124: What is the purpose of Schedule M-3?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents