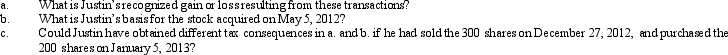

Justin owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $9,800). On April 27, 2012, he sells 300 shares for $2,800, while on May 5, 2012, he purchases 200 shares for $2,500.

Correct Answer:

Verified

Q24: Samuel's hotel is condemned by the City

Q26: For each of the following involuntary conversions,

Q27: After 5 years of marriage, Dave and

Q28: Janet, age 68, sells her principal residence

Q30: For the following exchanges, indicate which qualify

Q31: On January 5, 2012, Waldo sells his

Q32: Evelyn's office building is destroyed by fire

Q33: Beth sells investment land (adjusted basis of

Q34: Lucinda, a calendar year taxpayer, owned a

Q216: When a property transaction occurs, what four

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents