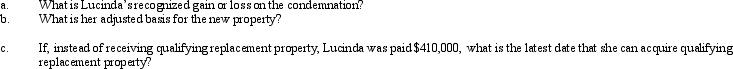

Lucinda, a calendar year taxpayer, owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12, 2012.In order to build a convention center, Lucinda eventually received qualified replacement property from the city government on March 9, 2013.This new property has a fair market value of $410,000.

Correct Answer:

Verified

Q29: Justin owns 1,000 shares of Oriole Corporation

Q30: For the following exchanges, indicate which qualify

Q31: On January 5, 2012, Waldo sells his

Q32: Evelyn's office building is destroyed by fire

Q33: Beth sells investment land (adjusted basis of

Q36: Lynn transfers her personal use automobile to

Q37: Patty's factory building, which has an adjusted

Q38: a. Orange Corporation exchanges a warehouse located

Q39: Don, who is single, sells his personal

Q101: Mandy and Greta form Tan, Inc., by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents