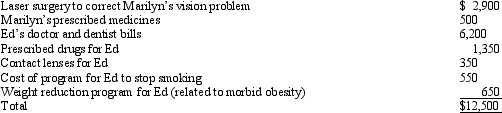

Marilyn, Ed's daughter who would otherwise qualify as his dependent, filed a joint return with her husband Henry. Ed, who had AGI of $150,000, incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

A) $0.

B) $50.

C) $1,250.

D) $12,500.

E) None of the above.

Correct Answer:

Verified

Q60: Gambling losses may be deducted to the

Q62: In 2012, Boris pays a $3,800 premium

Q63: In Shelby County, the real property tax

Q64: Joseph and Sandra, married taxpayers, took out

Q66: David, a single taxpayer, took out a

Q67: Pedro's child attends a school operated by

Q67: Karen, a calendar year taxpayer, made the

Q68: In 2012, Roseann makes the following donations

Q69: Diego, who is single and lives alone,

Q70: Brad, who uses the cash method of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents