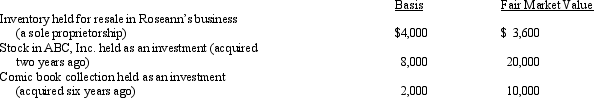

In 2012, Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

Correct Answer:

Verified

Q63: In Shelby County, the real property tax

Q64: Joseph and Sandra, married taxpayers, took out

Q65: Marilyn, Ed's daughter who would otherwise qualify

Q66: David, a single taxpayer, took out a

Q67: Karen, a calendar year taxpayer, made the

Q69: Diego, who is single and lives alone,

Q70: Brad, who uses the cash method of

Q71: In 2012, Jerry pays $8,000 to become

Q72: Rosie owned stock in Acme Corporation that

Q73: During 2012, Nancy paid the following taxes:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents