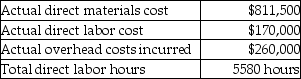

Doric Agricultural Corporation uses a predetermined overhead allocation rate based on the direct labor cost.The manufacturing overhead cost allocated during the year is $270,000.The details of production and costs incurred during the year are as follows:

What is the predetermined overhead allocation rate applied by the corporation? (Round your answer to two decimal places. )

A) 96.30%

B) 65.38%

C) 158.82%

D) 33.27%

Correct Answer:

Verified

Q95: Iglesias,Inc.completed Job 12 on November 30.The details

Q97: Irene Manufacturing uses a predetermined overhead allocation

Q97: Gardner Machine Shop estimates manufacturing overhead costs

Q98: Gill Manufacturing uses a predetermined overhead allocation

Q99: Midtown,Inc.uses a predetermined overhead allocation rate of

Q101: The cost of goods manufactured is recorded

Q103: Ivade,Inc.uses a predetermined overhead allocation rate of

Q104: The records at Smith and Jones,Inc.show that

Q104: Forsyth,Inc.uses estimated direct labor hours of 240,000

Q116: In a machine-intensive production environment,the most accurate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents