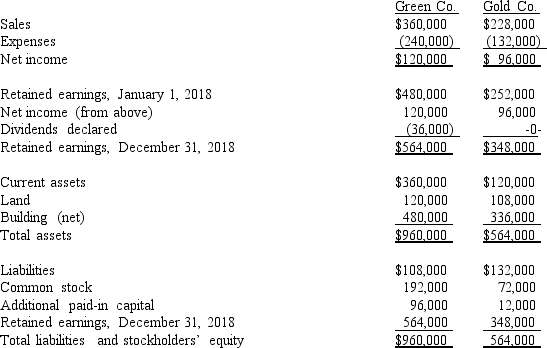

The following are preliminary financial statements for Green Co.and Gold Co.for the year ending December 31,2018 prior to Black's acquisition of Blue.

On December 31,2018 (subsequent to the preceding statements),Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities,prepare a consolidation worksheet as of December 31,2018 after the acquisition transaction is completed.

Correct Answer:

Verified

Q104: How are direct combination costs, contingent consideration,

Q106: Prepare the journal entries to record: (1)

Q109: Jernigan Corp.had the following account balances

Q110: Determine consolidated Additional Paid-In Capital at December

Q111: On January 1,2018,Chester Inc.acquired 100% of

Q111: How are bargain purchases accounted for in

Q112: Determine the balance for Goodwill that would

Q114: The following are preliminary financial statements for

Q114: What is the difference in consolidated results

Q114: Required:

Determine consolidated net income for the year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents