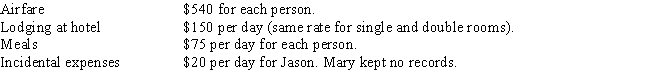

Jason travels to Miami to meet with a client.While in Miami,he spends 2 days meeting with his client and 3 days sightseeing.Mary,his wife,goes with him and spends all 5 days sightseeing and shopping.The cost of the trip is as follows:

If Jason is self-employed,what is the amount of the deduction he may claim for the trip?

A) $- 0 -

B) $415

C) $490

D) $955

E) $1,765

Correct Answer:

Verified

Q23: Arlene,a criminal defense attorney inherits $500,000 from

Q24: Which of the following business expenses is/are

Q25: Donna is an audit supervisor with the

Q26: Penny owns her own business and drives

Q27: Which of the following business expenses is/are

Q30: In 2016,Eileen,a self-employed nurse,drives her car 20,000

Q31: Mercedes is an employee of MWH company

Q32: Rodrigo works as a salesperson for a

Q33: During 2016,Marsha,an employee of G&H CPA firm,drove

Q55: Francine operates an advertising agency. To show

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents