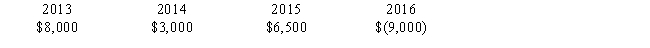

Billingsworth Corporation has the following net capital gains and losses for 2013 through 2016.Billingsworth' marginal tax rate is 34% for all years.

In 2016,Billingsworth Corporation earned net operating income of $30,000.What is/are the tax effect(s) of the $9,000 net capital loss in 2016?

I.Corporate taxable income is $21,000.

II.The net capital loss will provide income tax refunds totaling $3,060.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q61: Melinda and Riley are married taxpayers. During

Q62: Which of the following losses are generally

Q63: Frasier sells some stock he purchased several

Q73: Mario's delivery van is completely destroyed when

Q79: In addition to his salary, Peter realizes

Q81: The wash sale provisions apply to which

Q82: Erline begins investing in various activities during

Q85: Samantha sells the following assets and realizes

Q108: Maryanne is the senior chef for Bistro

Q116: Ronald is exploring whether to open a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents