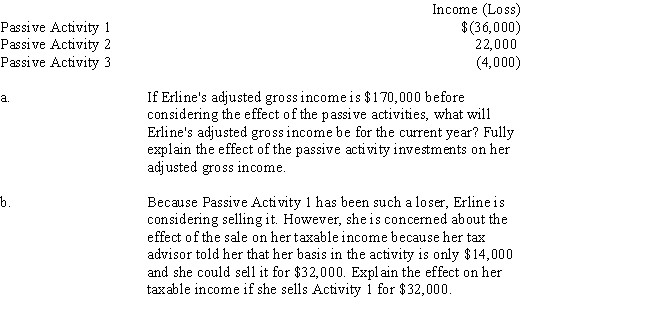

Erline begins investing in various activities during the current year.Unfortunately,her tax advisor fails to warn her about the passive loss rules.The results of the three passive activities she purchased for the current year are:

Correct Answer:

Verified

Q61: Melinda and Riley are married taxpayers. During

Q63: Frasier sells some stock he purchased several

Q79: In addition to his salary, Peter realizes

Q80: Billingsworth Corporation has the following net capital

Q81: The wash sale provisions apply to which

Q85: Samantha sells the following assets and realizes

Q86: During the current year,Cathy realizes

Q108: Maryanne is the senior chef for Bistro

Q109: Discuss the difference(s) between the real estate

Q116: Ronald is exploring whether to open a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents