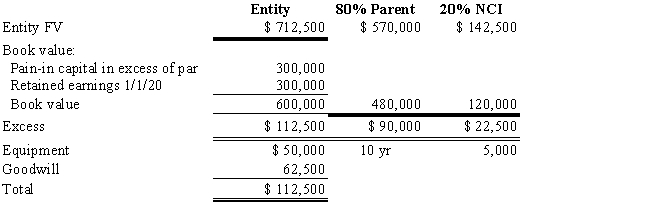

Company S has been an 80%-owned subsidiary of Company P since January 1, 2018.The determination and distribution of excess schedule prepared at the time of purchase was as follows:

?

?

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

?

The only change in plant assets during 2019 was that Company S sold a machine for $10,000.The machine had a cost of $60,000 and accumulated depreciation of $40,000.Depreciation expense recorded during 2019 was as follows:

?

?

The 2019 consolidated income was $180,000, of which the NCI was $10,000.Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

?

Consolidated inventory was $287,000 in 2018 and $223,000 in 2019; consolidated current liabilities were $246,000 in 2018 and $216,700 in 2019.Cash increased by $203,700.

?

Required:

?

Using the indirect method and the information provided, prepare the 2019 consolidated statement of cash flows for Company P.and its subsidiary, Company S.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: One complication that arises in consolidation when

Q24: Because good will is amortized over 15

Q25: The following comparative consolidated trial balances

Q26: In calculating the voting power and market

Q27: When an affiliated group elects to be

Q29: When there is an excess of fair

Q30: Consolidated firms that meet the tax law

Q31: Company P purchased an 80% interest in

Q32: Company P purchased an 80% interest in

Q33: For companies that meet the requirements of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents