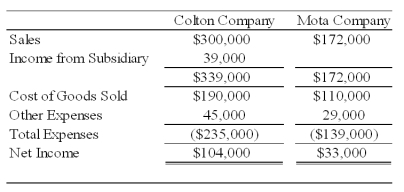

Colton Company acquired 80 percent ownership of Mota Company's voting shares on January 1,2008,at underlying book value.The fair value of the noncontrolling interest on that date was equal to 20 percent of the book value of Mota Company.During 2008,Colton purchased inventory for $30,000 and sold the full amount to Mota Company for $50,000.On December 31,2008,Mota's ending inventory included $10,000 of items purchased from Colton.Also in 2008,Mota purchased inventory for $80,000 and sold the units to Colton for $100,000.Colton included $30,000 of its purchase from Mota in ending inventory on December 31,2008.Summary income statement data for the two companies revealed the following:

Required:

a.Compute the amount to be reported as sales in the 20X8 consolidated income statement.

b.Compute the amount to be reported as cost of goods sold in the 20X8 consolidated income statement.

c.What amount of income will be assigned to the noncontrolling shareholders in the 20X8 consolidated income statement?

d.What amount of income will be assigned to the controlling interest in the 20X8 consolidated income statement?

Problem 63 (continued)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Potter Company acquired 75 percent ownership of

Q43: Potter Company acquired 75 percent ownership of

Q53: Parent Corporation owns 90 percent of Subsidiary

Q54: Parent Corporation owns 90 percent of Subsidiary

Q57: Clark Co.had the following transactions with affiliated

Q62: Pisa Company acquired 75 percent of Siena

Q63: Pisa Company acquired 75 percent of Siena

Q64: Hunter Company and Moss Company both produce

Q65: Pisa Company acquired 75 percent of Siena

Q66: On January 1,20X7,Jones Company acquired 90 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents