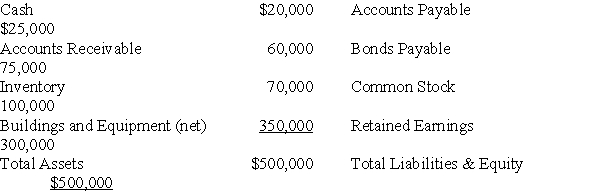

Autumn Corporation acquired 90 percent of the stock of Spring Company on January 1, 20X2, for $360,000. At that date, the fair value of the noncontrolling interest was $40,000. Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years, Spring reported net income of $70,000 and paid dividends of $20,000. On January 1, 20X4, Autumn sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash. Autumn used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years, Spring reported net income of $70,000 and paid dividends of $20,000. On January 1, 20X4, Autumn sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash. Autumn used the fully adjusted equity method in accounting for its ownership of Spring Company.

-Based on the preceding information,in the journal entry recorded by Autumn for the sale of shares

A) Cash will be credited for $90,000.

B) Investment in Spring Stock will be credited for $90,000.

C) Investment in Spring Stock will be credited for $75,000.

D) Additional Paid-in Capital will be credited for $9,000.

Correct Answer:

Verified

Q30: Petunia Corporation acquired 90 percent of the

Q30: Cinema Company acquired 70 percent of Movie

Q31: Perfect Corporation acquired 70 percent of Trevor

Q33: Vision Corporation acquired 75 percent of the

Q34: Vision Corporation acquired 75 percent of the

Q36: Perfect Corporation acquired 70 percent of Trevor

Q37: Autumn Corporation acquired 90 percent of the

Q38: Cinema Company acquired 70 percent of Movie

Q39: Perfect Corporation acquired 70 percent of Trevor

Q40: Vision Corporation acquired 75 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents