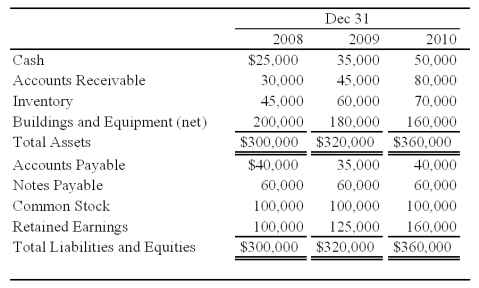

Perfect Corporation acquired 70 percent of Trevor Company's shares on December 31, 2008, for $140,000. At that date, the fair value of the noncontrolling interest was $60,000. On January 1, 2010, Perfect acquired an additional 10 percent of Trevor's common stock for $32,500. Summarized balance sheets for Trevor on the dates indicated are as follows:

Trevor paid dividends of $10,000 in each of the three years. Perfect uses the fully adjusted equity method in accounting for its investment in Trevor and amortizes all differentials over 5 years against the related investment income. All differentials are assigned to patents in the consolidated financial statements.

-Based on the preceding information,Trevor Company's net income for 2009 and 2010 are:

A) $10,000 and $20,000 respectively.

B) $25,000 and $35,000 respectively.

C) $35,000 and $45,000 respectively.

D) $25,000 and $45,000 respectively.

Correct Answer:

Verified

Q30: Petunia Corporation acquired 90 percent of the

Q31: Perfect Corporation acquired 70 percent of Trevor

Q33: Vision Corporation acquired 75 percent of the

Q34: Vision Corporation acquired 75 percent of the

Q35: Autumn Corporation acquired 90 percent of the

Q37: Autumn Corporation acquired 90 percent of the

Q38: Cinema Company acquired 70 percent of Movie

Q39: Perfect Corporation acquired 70 percent of Trevor

Q40: Vision Corporation acquired 75 percent of the

Q60: On January 1,20X7,Pisa Company acquired 80 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents