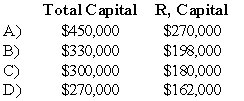

RD formed a partnership on February 10,20X9.R contributed cash of $150,000,while D contributed inventory with a fair value of $120,000.Due to R's expertise in selling,D agreed that R should have 60 percent of the total capital of the partnership.R and D agreed to recognize goodwill.What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q4: When a partnership is formed,noncash assets contributed

Q10: The terms of a partnership agreement provide

Q15: Cor-Eng Partnership was formed on January 2,20X1.Under

Q16: Which of the following accounts could be

Q17: The SRT partnership agreement specifies that partnership

Q17: Transferable interest of a partner includes all

Q18: The JPB partnership reported net income of

Q28: When a partner retires from a partnership

Q29: In the RST partnership,Ron's capital is $80,000,Stella's

Q37: When a new partner is admitted into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents