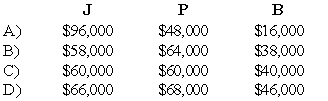

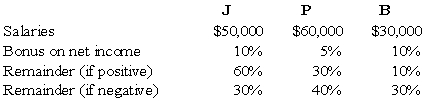

The JPB partnership reported net income of $160,000 for the year ended December 31,20X8.According to the partnership agreement,partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to J,P,and B?

How should partnership net income for 20X8 be allocated to J,P,and B?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q4: When a partnership is formed,noncash assets contributed

Q13: Roberts and Smith drafted a partnership agreement

Q15: Cor-Eng Partnership was formed on January 2,20X1.Under

Q16: Which of the following accounts could be

Q17: The SRT partnership agreement specifies that partnership

Q17: Transferable interest of a partner includes all

Q19: RD formed a partnership on February 10,20X9.R

Q28: When a partner retires from a partnership

Q29: In the RST partnership,Ron's capital is $80,000,Stella's

Q37: When a new partner is admitted into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents