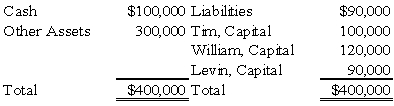

On December 1,20X9,the partners of Tim,Williams,and Levin,who share profits and losses in the ratio of 4:4:2,decided to liquidate their partnership.On this date the partnership condensed balance sheet was as follows:  On December 11,20X9,the first cash sale of other assets with a carrying amount of $200,000 realized $140,000.Safe installment payments to the partners were made on the same date.How much cash should be distributed to each partner?

On December 11,20X9,the first cash sale of other assets with a carrying amount of $200,000 realized $140,000.Safe installment payments to the partners were made on the same date.How much cash should be distributed to each partner?

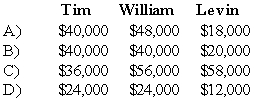

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q5: The trial balance of WM Partnership is

Q15: The trial balance of WM Partnership is

Q23: Siera, Lani, and Cecilia are partners in

Q24: Tom, Dick, and Harry are partners in

Q25: Partners David and Goliath have decided to

Q26: Partners Dennis and Lilly have decided to

Q26: Partners David and Goliath have decided to

Q28: Siera, Lani, and Cecilia are partners in

Q31: Siera, Lani, and Cecilia are partners in

Q39: Partners Dennis and Lilly have decided to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents