Siera, Lani, and Cecilia are partners in an equipment leasing business that has not been able to generate the type of revenue expected by the partners. They share profits and losses in a ratio of 5:3:2, respectively. They have decided to liquidate the business and have sold all the assets except for one piece of heavy machinery. All the partners are personally insolvent. The machinery has a book value of $120,000, and the partners have capital balances as follows:

Each of the following is an independent case.

Each of the following is an independent case.

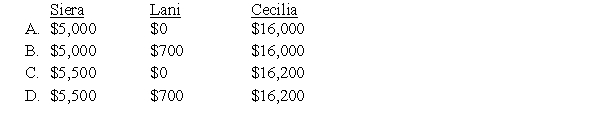

-Refer to the information given above.What amount of cash will each partner receive as a liquidating distribution if the machinery is sold for $51,000?

Correct Answer:

Verified

Q1: When is a partnership considered to be

Q15: The trial balance of WM Partnership is

Q18: The following condensed balance sheet is presented

Q19: Bill,Page,Larry,and Scott have decided to terminate their

Q24: Tom, Dick, and Harry are partners in

Q25: Partners David and Goliath have decided to

Q26: Partners Dennis and Lilly have decided to

Q27: On December 1,20X9,the partners of Tim,Williams,and Levin,who

Q28: Siera, Lani, and Cecilia are partners in

Q35: Partners David and Goliath have decided to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents