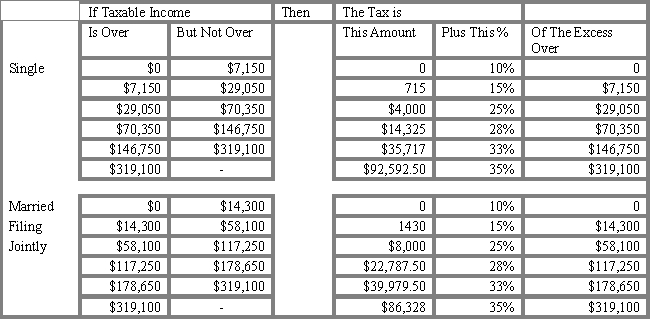

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the marginal tax rate for a single individual with taxable income of $85,000?

A) 15%

B) 25%

C) 28%

D) 33%

E) 35%

Correct Answer:

Verified

Q51: You currently have $150,000 in an IRA

Q52: An individual in the 15 percent tax

Q53: Suppose the 8 percent investment of the

Q54: _ gains are taxable and occur when

Q55: What would the after-tax yield be on

Q57: USE THE TAX TABLE PROVIDED BELOW FOR

Q58: Which of the following is NOT a

Q59: Which of the following statements is TRUE?

A)

Q60: USE THE TAX TABLE PROVIDED BELOW FOR

Q61: Adding Japanese, Australian, and Italian stocks to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents