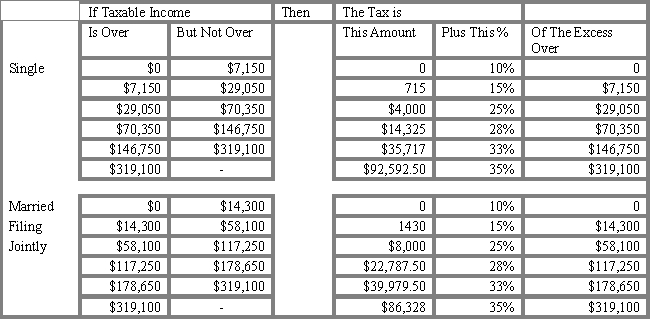

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a single individual with taxable income of $85,000?

A) $23,800

B) $18,427

C) $24,958

D) $16,867

E) $19,650

Correct Answer:

Verified

Q52: An individual in the 15 percent tax

Q53: Suppose the 8 percent investment of the

Q54: _ gains are taxable and occur when

Q55: What would the after-tax yield be on

Q56: USE THE TAX TABLE PROVIDED BELOW FOR

Q58: Which of the following is NOT a

Q59: Which of the following statements is TRUE?

A)

Q60: USE THE TAX TABLE PROVIDED BELOW FOR

Q61: Adding Japanese, Australian, and Italian stocks to

Q62: Asset allocation is

A) the process of dividing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents