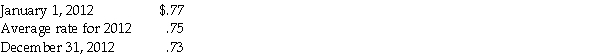

On January 1, 2012, Planet Corporation, a U.S.company, acquired 100% of Star Corporation of Bulgaria, paying an excess of 90,000 Bulgarian lev over the book value of Star's net assets.The excess was allocated to undervalued equipment with a three-year remaining useful life.Star's functional currency is the Bulgarian lev.Star's books are maintained in the functional currency.Exchange rates for Bulgarian lev for 2012 are:

Required:

Required:

1.Determine the depreciation expense stated in U.S.dollars on the excess allocated to equipment for 2012.

2.Determine the unamortized excess allocated to equipment on December 31, 2012 in U.S.dollars.

3.If Star's functional currency was the U.S.dollar, what would be the depreciation expense on the excess allocated to the equipment for 2012?

Correct Answer:

Verified

Depreciation expense in 20...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: When translating foreign subsidiary income statements using

Q5: A foreign subsidiary's accounts receivable balance should

Q10: Assume the functional currency of a foreign

Q13: A U.S.parent corporation loans funds to a

Q21: Pritt Company purchased all the outstanding stock

Q23: Pew Corporation (a U.S.corporation)acquired all of the

Q24: Note to Instructor: This exam item is

Q25: Puddle Incorporated purchased an 80% interest in

Q26: Note to Instructor: This exam item is

Q27: Note to Instructor: This exam item is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents