Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

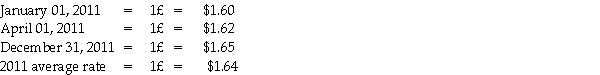

The Polka Corporation, a U.S.corporation, formed a British subsidiary on January 1, 2011 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary, Stripe Corporation, purchased real property on April 1, 2011 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency, but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

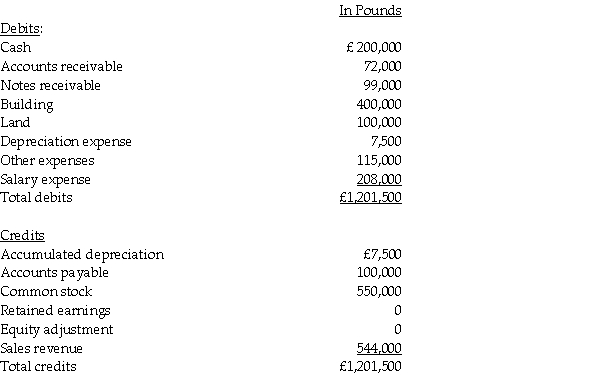

Stripe's adjusted trial balance is presented below for the year ended December 31, 2011.

Stripe's adjusted trial balance is presented below for the year ended December 31, 2011.

Required: Prepare Stripe's:

Required: Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement; and

3.Remeasured balance sheet.

Correct Answer:

Verified

Q5: A foreign subsidiary's accounts receivable balance should

Q10: Assume the functional currency of a foreign

Q21: Pritt Company purchased all the outstanding stock

Q22: On January 1, 2012, Planet Corporation, a

Q23: Pew Corporation (a U.S.corporation)acquired all of the

Q25: Puddle Incorporated purchased an 80% interest in

Q26: Note to Instructor: This exam item is

Q27: Note to Instructor: This exam item is

Q28: Pan Corporation, a U.S.company, formed a British

Q29: Each of the following accounts has been

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents