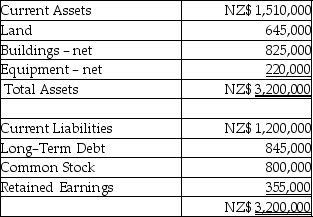

Par Industries, a U.S.Corporation, purchased Slice Company of New Zealand for $1,411,800 on January 1, 2011.Slice's functional currency is the New Zealand dollar (NZ$).Slice's books are kept in NZ$.The book values of Slice's assets and liabilities were equal to fair values, with the exception of land which was valued at NZ$1,300,000.Slice's balance sheet appears below:

Relevant exchange rates are shown below:

Relevant exchange rates are shown below:

Required:

Required:

Determine the unrealized translation gain or loss at December 31, 2011 relating to the excess allocated to the undervalued land.

Correct Answer:

Verified

Q29: Each of the following accounts has been

Q30: For each of the 12 accounts listed

Q31: Plato Corporation, a U.S.company, purchases all of

Q32: Plane Corporation, a U.S.company, owns 100% of

Q33: On January 1, 2011, Pilgrim Corporation, a

Q34: On January 1, 2011, Placid Corporation acquired

Q35: On January 1, 2011, Paste Unlimited, a

Q36: On January 1, 2011, Psalm Corporation purchased

Q38: Plate Corporation, a US company, acquired ownership

Q39: Phim Inc., a U.S.company, owns 100% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents