On November 1, 2010, Ironside Company (a U.S.manufacturer)sold an airplane for 1 million New Zealand dollars (NZ$)to a New Zealand company, Wellington Corporation.Ironside will receive payment on January 30, 2011 in New Zealand dollars.In order to hedge the accounts receivable position, Ironside entered into a 90-day forward contract on November 1, 2010 to sell 1 million New Zealand dollars.On November 1, 2010, the forward rate is US$0.79 per New Zealand dollar.The forward contract will be settled net.This is a fair value hedge.Ignore the time value of money.

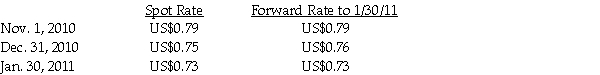

The relevant exchange rates per New Zealand dollar:

Required:

Required:

Record the journal entries that Stateside would need to prepare at November 1, 2010, December 31, 2010 and January 30, 2011.

December 31 is the fiscal year end.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: On June 1,2011,Dapple Industries purchases an option

Q25: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q31: Ferb Company is a U.S.-based importer of

Q31: On November 1,2010,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q32: On November 1, 2010, Stateside Company (a

Q35: On December 15, 2011, Electronix Company purchased

Q35: On November 1,2010,Athom Corporation purchased 5,000 television

Q38: Ivan has 14,000 barrels of oil that

Q39: Astrotuff Company is planning to purchase 200,000

Q39: On November 1, 2011, Moddel Company (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents