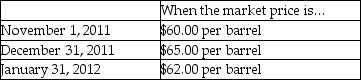

Ivan has 14,000 barrels of oil that were purchased a month ago at $50.00 per barrel.On November 1, 2011 Ivan hedges the value of the inventory by entering into a forward contract to sell 14,000 barrels of oil on January 31, 2012 for $60.00 per barrel.The forward contract is to be settled net.

Assume this is a fair value hedge.

Required:

Assume a 6% discount rate is reasonable, and using a mixed-attribute model, prepare the journal entries to account for this hedge at the following dates:

Correct Answer:

Verified

Q21: On June 1,2011,Dapple Industries purchases an option

Q25: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q31: Ferb Company is a U.S.-based importer of

Q31: On November 1,2010,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q32: On November 1, 2010, Stateside Company (a

Q35: On December 15, 2011, Electronix Company purchased

Q35: On November 1,2010,Athom Corporation purchased 5,000 television

Q37: On November 1, 2010, Ironside Company (a

Q39: Astrotuff Company is planning to purchase 200,000

Q39: On November 1, 2011, Moddel Company (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents