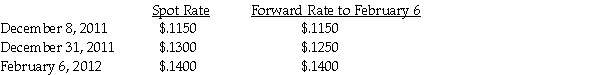

Onoly Corporation (a U.S.manufacturer)sold parts to its customer in Hong Kong on December 8, 2011 with payment of 500,000 Hong Kong Dollars (HKD)to be received in sixty days on February 6, 2012.Onoly has a December 31 year end.The following exchange rates apply:

Required:

Required:

1.Assuming no forward contract is taken, what is the amount of foreign currency exchange gain or loss that would be recorded in 2011, and in 2012?

2.Assuming a 60-day forward contract is taken on December 8 with the intent of hedging this foreign currency transaction, and that this hedge is properly accounted for as a cash flow hedge, what is the net effect on income to be recorded in 2011, and in 2012?

Correct Answer:

Verified

If accounted for as a cas...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: International accounting standards differ from U.S.Generally Accepted

Q20: When a cash flow hedge is appropriate,the

Q21: Wild West, Incorporated (a U.S.corporation)sold inventory to

Q23: On November 1, 2011, Portsmith Corporation, a

Q23: On January 1,2011,Bambi borrowed $500,000 from Lonni.The

Q26: On November 1, 2011, Ross Corporation, a

Q27: Slickton Corporation, a U.S.holding company, enters into

Q28: On December 18,2011,Wabbit Corporation (a U.S.Corporation)has a

Q28: On March 1, 2011, Amber Company sold

Q37: Opie Industries is a manufacturer of plastic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents