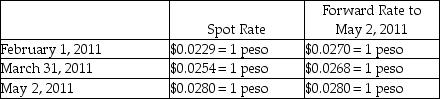

Wild West, Incorporated (a U.S.corporation)sold inventory to a company in the Philippines for 1,600,000 pesos on account on February 1, 2011, with payment expected in 90 days.Wild West entered into a forward contract to hedge this transaction, and properly accounts for the transaction as a cash flow hedge.Wild West has a March 31 fiscal year end, and uses an 8% discount rate, resulting in a 30-day present value factor of .9934.The forward contract is settled net.The relevant exchange rates are shown below:

Required:

Required:

Record the journal entries needed by Wild West on February 1, March 31, and May 2.Round all entries to the nearest whole dollar.

Correct Answer:

Verified

Q2: Use the following information to answer the

Q5: A fair value hedge differs from a

Q11: International accounting standards differ from U.S.Generally Accepted

Q19: A forward contract used as a cash

Q20: When a cash flow hedge is appropriate,the

Q23: On January 1,2011,Bambi borrowed $500,000 from Lonni.The

Q23: On November 1, 2011, Portsmith Corporation, a

Q24: Onoly Corporation (a U.S.manufacturer)sold parts to its

Q26: On November 1, 2011, Ross Corporation, a

Q28: On December 18,2011,Wabbit Corporation (a U.S.Corporation)has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents