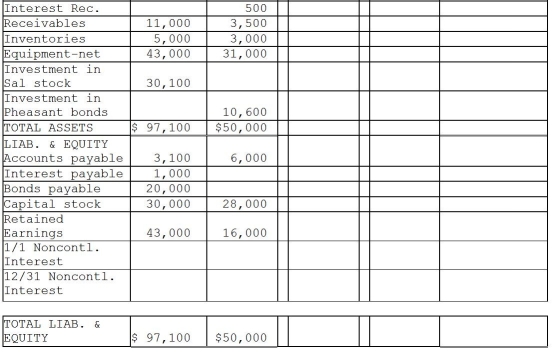

Pheasant Corporation owns 80% of Sal Corporation's outstanding common stock that was purchased at book value equal to fair value on January 1, 2005.

Additional information:

1.Pheasant sold inventory items that cost $3,000 to Sal during 2012 for $6,000.One-half of this merchandise was inventoried by Sal at year-end.At December 31, 2012, Sal owed Pheasant $2,000 on account from the inventory sales.No other intercompany sales of inventory have occurred since Pheasant acquired its interest in Sal.

2.Pheasant sold equipment with a book value of $5,000 and a 5-year useful life to Sal for $10,000 on December 31, 2010.The equipment remains in use by Sal and is depreciated by the straight-line method.The equipment has no salvage value.

3.On January 2, 2012, Sal paid $10,800 for $10,000 par value of Pheasant's 10-year, 10% bonds.These bonds were originally sold at par value, and have interest payment dates of January 1 and July 1, and mature on January 1, 2016.Straight-line amortization has been applied by Sal to the Pheasant bond investment.

4.Pheasant uses the equity method in accounting for its investment in Sal.

Required:

Complete the working papers to consolidate the financial statements of Pheasant Corporation and Sal for the year ended December 31, 2012.

Correct Answer:

Verified

Q9: Use the following information to answer the

Q21: Popcorn Corporation owns 90% of the outstanding

Q22: Peter Corporation owns a 70% interest in

Q24: Pachelor Corporation owns 70% of the outstanding

Q26: Pass Corporation owns 80% of Sindy Company,

Q28: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q29: Pare Corporation owns 65% of the outstanding

Q29: Paka Corporation owns an 80% interest in

Q31: Spott is a 75%-owned subsidiary of Penthal.On

Q35: Platts Incorporated purchased 80% of Scarab Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents