Pass Corporation owns 80% of Sindy Company, purchased at the underlying book value on January 1, 2010.On January 1, 2010, Pass also purchased $200,000 par value 6% bonds that had been issued by Sindy on January 1, 2007 with a ten-year maturity(due January 1, 2017).Annual interest is paid on December 31.Straight-line amortization is used by both companies.

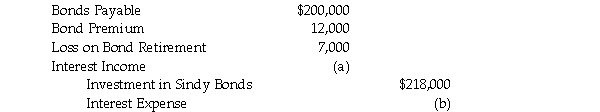

At year-end 2010, the following entry was made on the consolidating worksheet.

Required:

Required:

1.How much did Pass pay for the bonds?

2.What is the book value of the bonds on the date of purchase?

3.What amount of interest income and interest expense must be eliminated in the entry above designated as (a)and (b)?

Correct Answer:

Verified

Bonds issued 1/1/07 and ma...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Popcorn Corporation owns 90% of the outstanding

Q22: Peter Corporation owns a 70% interest in

Q24: Pachelor Corporation owns 70% of the outstanding

Q25: Pheasant Corporation owns 80% of Sal Corporation's

Q28: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q29: Pare Corporation owns 65% of the outstanding

Q29: Paka Corporation owns an 80% interest in

Q31: Spott is a 75%-owned subsidiary of Penthal.On

Q31: Patama Holdings owns 70% of Seagull Corporation.On

Q35: Platts Incorporated purchased 80% of Scarab Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents