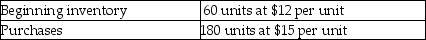

The following data was collected from the accounting records of Ambrose, Inc., for the month of June. 200 units were sold during the month. Ambrose currently uses the FIFO method of valuing inventory.  What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

A) Ending inventory would have been $120 higher.

B) Ending inventory would have been $120 lower.

C) Ending inventory is the same under both methods.

D) The difference cannot be determined using this information.

Correct Answer:

Verified

Q92: Given the following data, by how much

Q93: Toyland's inventory records show the following data

Q94: The following data was extracted from the

Q95: Given the following data, calculate the cost

Q96: The following data was extracted from the

Q98: A company has a beginning inventory of

Q99: Winter Fun, Inc., had the following data

Q100: Given the following data, by how much

Q101: The lower-of-cost-or-market rule requires a company to

Q102: The disclosure principle requires that management prepare

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents