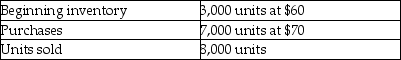

Given the following data, by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $20,000

B) Decrease by $19,000

C) Increase by $20,000

D) Increase by $19,000

Correct Answer:

Verified

Q95: Given the following data, calculate the cost

Q96: The following data was extracted from the

Q97: The following data was collected from the

Q98: A company has a beginning inventory of

Q99: Winter Fun, Inc., had the following data

Q101: The lower-of-cost-or-market rule requires a company to

Q102: The disclosure principle requires that management prepare

Q103: Under the disclosure principle, the inventory accounting

Q104: The lower-of-cost-or-market rule is based on the

Q105: The conservatism principle dictates that inventory be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents