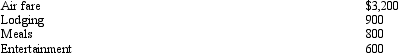

During the year,Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

A) $5,500.

B) $4,800.

C) $3,900.

D) $3,200.

E) None of the above.

Correct Answer:

Verified

Q65: Statutory employees:

A) Report their expenses on Form

Q86: Bill is the regional manager for a

Q90: The § 222 deduction for tuition and

Q94: Allowing for the cutback adjustment (50% reduction

Q95: Aaron is a self-employed practical nurse who

Q96: Under the actual expense method,which,if any,of the

Q98: The § 222 deduction for tuition and

Q100: When using the automatic mileage method,which,if any,of

Q101: Eva holds two jobs and attends graduate

Q102: Donna,age 27 and unmarried,is an active participant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents