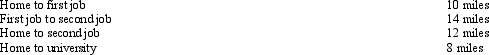

Eva holds two jobs and attends graduate school on weekends.The education improves her skills,but does not qualify her for a new trade of business.Before going to the second job,she returns home for dinner.Relevant mileage is as follows?

How much of the mileage qualifies for deduction purposes?

How much of the mileage qualifies for deduction purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Statutory employees:

A) Report their expenses on Form

Q94: Allowing for the cutback adjustment (50% reduction

Q96: Under the actual expense method,which,if any,of the

Q97: During the year,Walt went from Louisville to

Q100: When using the automatic mileage method,which,if any,of

Q102: Donna,age 27 and unmarried,is an active participant

Q103: Match the statements that relate to each

Q104: Susan is a self-employed accountant with a

Q105: During 2011,Marcie used her car as follows:

Q112: Which, if any, of the following expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents