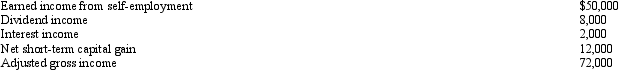

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2011,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2011,assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $46,000.

D) $46,468.

E) None of the above.

Correct Answer:

Verified

Q94: Allowing for the cutback adjustment (50% reduction

Q100: When using the automatic mileage method,which,if any,of

Q101: Eva holds two jobs and attends graduate

Q102: Donna,age 27 and unmarried,is an active participant

Q103: Match the statements that relate to each

Q105: During 2011,Marcie used her car as follows:

Q106: In contrasting the reporting procedures of employees

Q108: Rod is employed as an auditor by

Q112: Which, if any, of the following expenses

Q116: Which, if any, of the following expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents