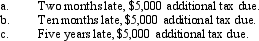

Isaiah filed his Federal income tax return on time,but he did not remit the full balance due.Compute Isaiah's failure to pay penalty in each of the following cases.The IRS has not yet issued a deficiency notice.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: To file for a tax refund, an

Q105: According to AICPA rules, the CPA cannot

Q105: The taxpayer can avoid a valuation penalty

Q108: The Code's scope of privileged communications for

Q109: The general statute of limitations regarding Federal

Q118: Compute the failure to pay and failure

Q120: Maria's AGI last year was $195,000. To

Q121: Compute the overvaluation penalty for each of

Q139: A(n) _ member is required to follow

Q151: If a taxpayer is audited by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents