Compute the failure to pay and failure to file penalties for John,who filed his 2010 income tax return on December 14,2011,paying the $10,000 amount due.On April 1,2011,John submitted a six-month extension of time in which to file his return; he paid no tax with the extension request.He has no reasonable cause for failing to file his return by October 15 or for failing to pay the tax that was due on April 15,2011.John's failure to comply with the tax laws was not fraudulent.

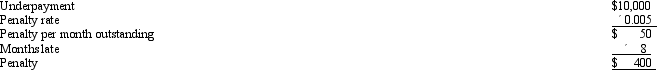

Failure to Pay

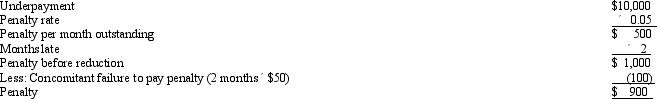

Failure to File

Failure to File

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: To file for a tax refund, an

Q105: According to AICPA rules, the CPA cannot

Q108: The Code's scope of privileged communications for

Q109: The general statute of limitations regarding Federal

Q117: Isaiah filed his Federal income tax return

Q120: Maria's AGI last year was $195,000. To

Q121: Compute the overvaluation penalty for each of

Q123: Compute the undervaluation penalty for each of

Q139: A(n) _ member is required to follow

Q151: If a taxpayer is audited by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents